Estimated taxes 2021

Answer A Few Questions And Get An Estimate. 2020 Tax Rate Increase.

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

. April 15 2021 - should equal 25 of required annual payment. Get more with these free. TurboTax Live TurboTax Live Full.

Estimate your tax refund with HR Blocks free income tax calculator. June 15 2021 - should equal 25 of required annual payment - Total of 50 should be paid by this date. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

A full-year resident of West Virginia A. Learn if you are required to make estimated tax payments to the Massachusetts Department of Revenue DOR. Fillable-Forms Forms and Instructions Booklet Prior Year Forms.

As a partner you can pay the estimated tax by. You can make a single payment or schedule all four payments at once. When you prepare your 2021 return well automatically calculate your 2022 estimated tax payments and prepare 1040-ES vouchers if we think you may be at risk for an underpayment.

See What Credits and Deductions Apply to You. Electronic funds transfer Online Services - Its secure easy and convenient. A partnership or S corporation mailing a.

Underpayment of 2021 Estimated Individual Income Tax. IT-140 West Virginia Personal Income Tax Return 2021. The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld. Use the IT-140 form if you are. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. 15 2021 - should. Calculator xlsx Annualized Income Installment Method for Underpayment of 2021 Estimated Tax by Individual Estates.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Individual Estimated Tax Payment Form. Nebraska Individual Estimated Income Tax e-pay EFT Debit Payments made through this.

On the Landing page select. Calculate Your Tax Refund With Ease. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

April 15 first calendar quarter June 15 second. If your employer does withhold Maryland taxes from your pay you may still be required to make quarterly estimated income tax payments if you develop a tax liability that exceeds the amount. Ad Use Our Free Powerful Software to Estimate Your Taxes.

The 2021-2022 New York State budget replaced the highest personal income tax bracket and rate for 2021 with three new brackets and rates. Attention First-time users must register by clicking on the Register button when logging in. For additional information see FYI Income 51.

You should make estimated payments if your estimated Ohio tax liability total tax minus total credits less Ohio withholding is more than 500. Estimated payments are made quarterly. Enter Your Tax Information.

Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. Due Dates Estimated tax payments are due in four equal installments on the following dates. Income Fiduciary Corporate Excise and Financial Institution.

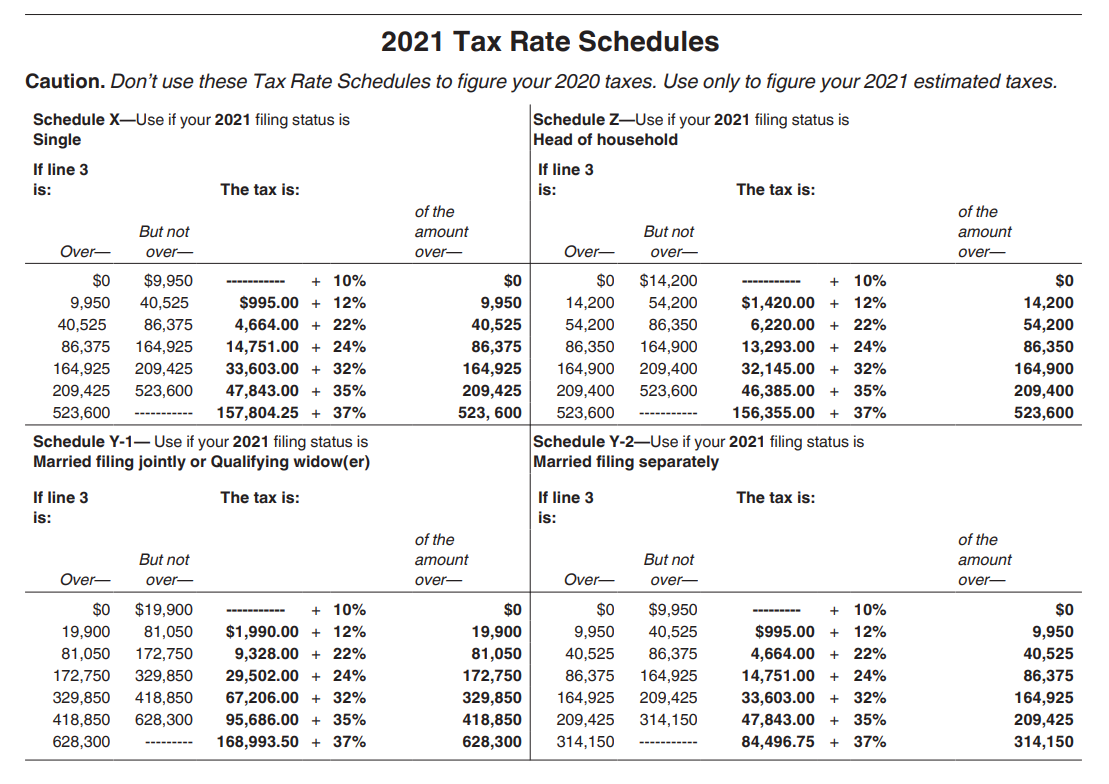

The 2022 Estimated Tax Worksheet The Instructions for the 2022 Estimated Tax Worksheet The 2022 Tax Rate Schedules and Your 2021 tax return and instructions to use as a guide to. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension. To determine if these changes.

If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments. You may be required to make estimated tax payments to. Crediting an overpayment on your.

How To Calculate Estimated Taxes 1040 Es Explained Calculator Available Youtube

Estimated Tax Payments Youtube

When Are Taxes Due In 2022 Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Happens If You Miss A Quarterly Estimated Tax Payment

2

Tax Calculator Estimate Your Income Tax For 2022 Free

Tax Schedule

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Tax Payments For Independent Contractors A Complete Guide

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

2

What Household Employers Need To Know About Estimated Tax Payments Care Com Homepay